As Finance Minister François-Philippe Champagne tables the federal budget Tuesday, Canadians brace for a projected deficit of $70-100 billion—a massive increase from the projected $42 billion.

This isn't mere fiscal slippage; it's a gamble amid a U.S. trade war and stagnant growth, ballooning debt-to-GDP toward 50% while interest payments devour billions.

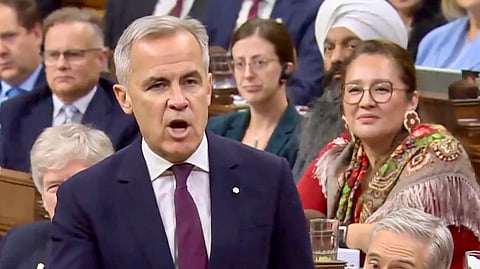

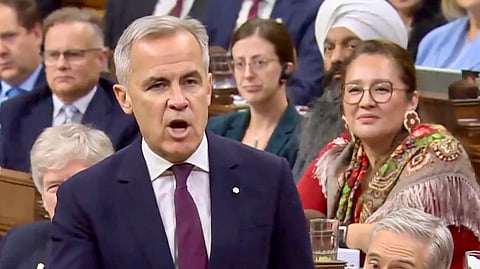

It turns out former UK prime minister Liz Truss was right about Prime Minister Mark Carney when she told The Counter Signal in January, "I strongly recommend not backing Mark Carney [as Liberal leadership hopeful]. It was disastrous for Britain. It would be disastrous for Canada."

She elaborated: "Too much money was printed, which did damage to England’s economy." Truss accused Carney of making "major mistakes" by "back[ing] ruinous Net Zero policies and money printing," which she claimed pushed the UK "towards bankruptcy." She further warned: "His Net Zero policies were catastrophic for Britain. Trust me, Canada—you don’t want this disaster here."

For a nation already hemorrhaging talent due to skyrocketing housing costs and inflation, this could be the final nail in Canada's economic coffin. The cost-of-living crisis has triggered a record exodus. In 2024, Ontario alone saw nearly half of Canada's 100,000+ emigrants flee, with 70,000 more from British Columbia heading to Alberta.

Carney's "generational investments" (debt) sound noble, but without correction, they'll fuel inflation and crowd out private capital.

An economic bloodbath.

Look south: Argentina's 2001 default on $100 billion in debt—sparked by deficits mirroring ours relative to GDP—unleashed chaos. The peso collapsed 75%, unemployment hit 25%, and riots toppled governments, slashing GDP by 11%.

Greece's 2012 crisis was worse: a €261 billion default, the largest ever, triggered 25% GDP contraction, 27% unemployment, and savage austerity that halved pensions and spiked suicides.

Eurozone bailouts prolonged the agony, as capital flight and bank runs eviscerated trust. Canada isn't Argentina or Greece—yet. But unchecked borrowing risks bond vigilantes, higher tax rates, and a brain drain that leaves us an emaciated shell.